Amendments can modify the ILOC’s terms, extend the expiry date, or adjust other conditions. All parties involved, including the issuing bank, need to agree and endorse the amendment. In a documentary collection, the buyer and seller exchange paperwork while also paying each other using a bank. In contrast to letters of credit, this form of e banks serve as mediators but do not guarantee payments. Instead, they help with the document exchange and obtain money from the buyer on the seller’s behalf.

Under a revocable letter of credit, if the seller team was unable to deliver the goods within the required time period, then the seller would simply change the shipment date that suits them. Writing your own irrevocable letter of credit may seem like a way to save money, but it can quickly become expensive and damaging for your business. To get a letter of credit, always seek help from the bank that will be involved in your transaction. Ultimately, however, the greatest risk in using a revocable letter of credit falls on sellers, who may find themselves responsible for the cost of both production and shipping with no recourse for being paid.

LIMITED PAY LIFE POLICY: Everything You Need To Know

A revocable letter of credit can be canceled or changed at any time without previous notification to or approval from the beneficiary. In this instance, payment is made after the Sight Letter of Credit and other required documentation are presented. This letter of credit is used by businesses when dealing with new consumers.

The payment is made to the beneficiary only after non-fulfillment of the obligations. However, like anything else related to banking, trade, and business there are some pros and cons to acknowledge. Banks will 10 challenges hr faces in a global company usually charge a fee for a letter of credit, which can be a percentage of the total credit that they are backing. The cost of a letter of credit will vary by bank and the size of the letter of credit.

What Is An Irrevocable Letter Of Credit?

While different, both bank guarantees and letters of credit assure the third party that if the borrowing party can’t repay what it owes, the financial institution will step in on behalf of the borrower. Letters of credit are often found in international trade, though they can also be used for domestic transactions. Irrevocable letters of credit cannot be changed or canceled without the permission of everybody involved (the buyer, the seller, and any banks involved), thus minimizing the risks that all parties take in the transaction. Neither the financial institution nor the offeror/Contractor can revoke or condition the letter of credit. One is a confirmed letter of credit in which three parties are involved, i.e. issuing bank, seller, and confirming bank.

- The issuing bank in international transactions typically requests this arrangement.

- Life has a way of surprising us, so you need to be very sure that circumstances won’t make you regret your choice.

- The primary disadvantage of having an irrevocable beneficiary is inflexibility.

- To receive an ILOC, contact your bank, which will assign you to a representative.

- A stepparent can’t cut off a child from a previous marriage or alter or challenge a policy after the death of the insured.

- Any deal containing a revocable letter of credit should be avoided by sellers.

For instance, a construction company and its cement supplier may enter into a contract to build a mall. Both parties may have to issue bank guarantees to prove their financial bona fides and capability. In a case where the supplier fails to deliver cement within a specified time, the construction company would notify the bank, which then pays the company the amount specified in the bank guarantee. Bank guarantees represent a more significant contractual obligation for banks than letters of credit do. A bank guarantee, like a letter of credit, guarantees a sum of money to a beneficiary. The bank only pays that amount if the opposing party does not fulfill the obligations outlined by the contract.

Such transfer or assignment shall be only at the written direction of the Government (the beneficiary) in a form satisfactory to the issuing financial institution and the confirming financial institution, if any. An irrevocable letter of credit, sometimes referred to as an irrevocable lc, is one which cannot be revoked or amended by the buyer or issuing bank without agreement from the seller. An irrevocable letter of credit is a mechanism a seller can use to reduce risk and facilitate payment for international trade. An irrevocable letter of credit is a financial instrument used by banks to guarantee a buyer’s obligations to a seller. It is irrevocable because the letter of credit cannot be modified unless all parties agree to the modifications. An irrevocable letter of credit helps eliminate concerns that unknown buyers will not pay for goods received or that unknown sellers will not ship goods paid for.

The Difference Between Accounts Payable and Notes Payable

There’s no significant difference in an LC or irrevocable LC at sight except that the latter is the quickest way to make the payment, i.e. within 5-10 days of meeting the requirements of the contract. Like an ordinary LC, LC at sight is presented to the issuing bank along with the supporting documents. This process of verifying and submitting the documents is called sighting LC. Irrevocable letters of credit are often used to facilitate international trade because of the additional risks involved. The irrevocable letter of credit assures the seller that it will be paid by the bank if the buyer fails to pay.

The guarantee can be used to essentially insure a buyer or seller from loss or damage due to nonperformance by the other party in a contract. For buyers, letters of credit help ensure that something has actually been shipped. However, your bank will make payment once your seller provides documents showing that a shipment was made. To manage risk, you can require that an inspection certificate be one of the required documents before payment can be made. When you do business with somebody in a foreign country (or even with a brand new customer or vendor in your home country), you have to trust them, even if you’ve never met the person you’re dealing with or don’t know much about their company. This can leave both buyers and sellers with significant concerns about payment and shipping.

If a buyer is unable to pay, the bank is obligated to pay on his or her behalf, either for the remainder or for the entire price of the purchase, depending on the circumstances. An irrevocable letter of credit is a financial instrument used by banks to guarantee a buyer’s obligations to a seller. It is irrevocable since the terms of the letter of credit cannot be changed unless all parties agree. Although most letters of credit involve international exchange, they can be used to help facilitate any type of trade.

The bank is, therefore, aware of the party’s creditworthiness and general financial status. If the buyer is unable to pay the seller, the bank is responsible for making the full payment. If the buyer has made a portion of the payment, the bank is responsible for paying the remainder.

Terms & Conditions of Irrevocable Letter of Credit

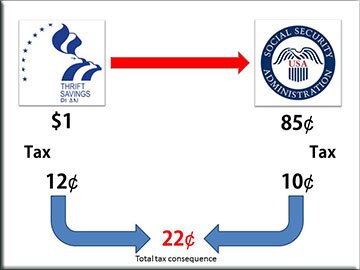

Considering the cost of ILOC to be 2% of the amount covered, the cost for ILOC will be $200. When the letter is canceled or changed without the permission of the beneficiary this becomes disadvantageous for the exporter. In international trading, there is a lack of personal contact, distance, and separate law in each country, etc. You may need an individual guarantee or a customs comprehensive guarantee to enter goods into a customs special procedure and defer duty.

Bank Guarantee vs. Letter of Credit: What’s the Difference? – Investopedia

Bank Guarantee vs. Letter of Credit: What’s the Difference?.

Posted: Tue, 13 Feb 2018 16:15:36 GMT [source]

(1) Only federally insured financial institutions rated investment grade by a commercial rating service shall issue or confirm the ILC. To understand an Irrevocable Letter of Credit, imagine a Jordanian firm (hereinafter buyer) entering into a contract to buy reinforced steel rods from a British firm (hereinafter seller) that needed to be delivered in two instalments. The buyer requested the issuing bank to issue two letters of credit in favour of the seller, out of which one LC was realized and paid as per the agreement upon the delivery of 1st instalment. This is a direct payment method in which the issuing bank makes the payments to the beneficiary.

Role of Commercial Banks in International Business

In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. We hereby establish this irrevocable and transferable Letter of Credit in your favor for one or more drawings up to United States $____. Irrevocable LC at sight guarantees payment to the seller in return for the goods and services rendered by the seller.

- Most often, this is seen in cases where there are dependent children, child support, or alimony involved.

- In contrast, a bank letter of credit is usually for one year, and you typically pay the bank about 1 percent of the amount covered in fees.

- After the goods have been shipped, the bank would pay the wholesaler their due as long as the terms of the sales contract are met, such as delivery before a certain time or confirmation from the buyer that the goods were received undamaged.

ILOCs are most commonly used to facilitate international trade because of the additional credit risk involved when two parties unfamiliar with each other are transacting business across national borders. An ILOC assures the seller of receiving payment because it is a guarantee by the issuing bank, the buyer’s bank, that it will make payment in the event the buyer fails to do so. By providing the seller with an assurance of payment, an ILOC also assists the buyer in arranging a transaction that the seller might otherwise be reluctant to make. Letters of credit are essentially agreements made between customers using each other’s banks.

Contents of an ILOC

Indirect guarantees are commonly issued when the subject of the guarantee is a government agency or another public entity. To ensure seamless transactions and a guarantee of payment to the seller, both parties. This means the buyer and the seller, must follow the conditions of the letter with 100 percent compliance. A letter of credit is used in a business transaction to guarantee that a payment will be made.

Therefore, irrevocable LC is more preferred by the buyers because the seller is required to apply for a shipment date extension in case he is unable to deliver on the decided date. It is extremely difficult to find a letter of credit that is not irrevocable. However, it’s always worth verifying whether or not you have an irrevocable or a revocable document. Note that in many cases, this format is acceptable and can be used for a variety of types of transactions. It may be that a specific template for an ILOC can be used with specific fields input or relevant bits of data added. This ILOC example outlines the terms of expiration, prevailing rules it may be subject to, and signature blocks required by different parties.

Most often, this is seen in cases where there are dependent children, child support, or alimony involved. As to irrevocable trusts, an additional disadvantage is that you lose control of the assets in the trust, ceding that control to a trustee. If you suddenly need to access the funds due to an emergency, you don’t have it. Sudden changes in the contract may drag the importers and exporter in the legal court to resolve the dispute.